Investment Management: Why invest in China?

The primary reason for any investment is always to seek higher returns. In China this is no different.

Why invest in China?

Over the long term in almost all markets, equities have the highest real returns. In China this is no different. In spite of endless debate around the merits of the Chinese economic system, what is undeniable is that over the long-term equity performs strongly. In addition to the equity returns, the second source of returns comes from the manager’s ability to beat the index also known as alpha. Alpha is an elusive concept in the developed market. Research after research shows just how difficult it is to generate alpha and the growth of passive and semi-passive strategies in developed markets reflects that reality.

Over the long term in almost all markets, equities have the highest real returns.

China is very unique as it is still in the early stages of capital market development with the capital market extremely inefficient. The capital market is quite large, both in terms of the number of securities as well as participants. Unlike most other inefficient markets, it is very tradable with low costs and thousands of stocks. By taking advantage of the inefficient capital market in China, using a disciplined and quantitative research based approach, we can strongly outperform the market delivering strong returns. The combination of the 2 effects means extremely strong returns over the long term.

By taking advantage of the inefficient capital market in China we can strongly outperform the market delivering strong returns.

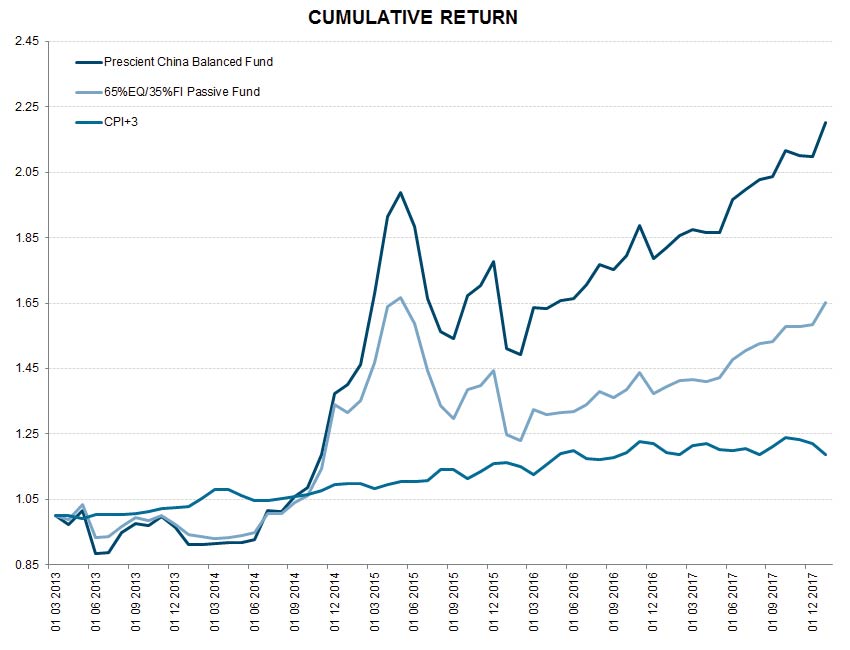

Since inception we have delivered very high real returns due with our fund’s return close to 17% in RMB since inception while a passive balanced index would have delivered 10% and inflation +3 of 4.5%.

Source: Prescient

The secondary consideration is always risk. One of the breakthroughs of modern finance is modern portfolio theory. The idea behind it is very simple. By combining a bunch of risky assets that have low correlations, the combined portfolio can achieve either the same return with lower risk or higher returns with the same risk. Here China is once again quite unique.

China continuously shows the lowest correlation to both emerging markets as well as developed markets.

China, big enough to house its own business cycle, monetary policy as well as market participants, consistently moves differently to every other market in the world. It continuously shows the lowest correlation to both emerging markets as well as developed markets. As such, by including China into the overall portfolio, one can add the most diversification to the overall portfolio benefiting from increases in return with the same risk or decreases in risk with the same return.

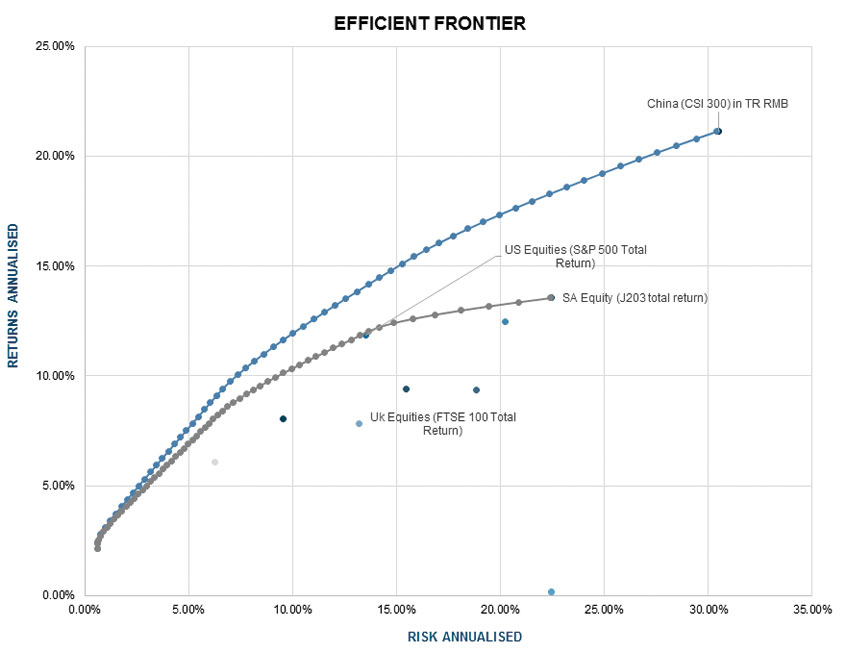

The returns and risks of different assets such as the US Equities, UK Equities, SA Equities is displayed in the chart below. Each line shows the efficient frontier, the optimal combination of assets which will result in the best return to risk combination. The Blue line includes China and the grey line excludes China. Based on this chart, it is clear that the addition of China dramatically changes the portfolio for the better.

Source: Data from Jan 2005 (start of CSI 300 Index) and June 2017, currently in GBP.