Fund Range Prescient China Equity Fund

Prescient China Equity Fund

Investment and Return Objective

The Fund aims to outperform the China Securities 300 Index (CSI 300 index) over the long-term. Returns can be volatile.

Investment Process

The Fund utilises quantitative techniques to identify equities securities listed or traded on recognised exchanges in the People's Republic of China (PRC) and in the Hong Kong Special Administrative Region. Company specific risks are diversified away while maintaining exposure to risk premia that are expected to deliver alpha. The equity process uses four factor groups to deliver alpha, being value, quality, behavioural and volatility. Strict risk control ensures diversificatoin, with bets relative to the benchmark limited in size, while maintaining active bets to generate alpha.

Who Should Invest

Investors seeking significant long-term real returns from a market that offers low correlation to world markets and who can withstand significant equity market volatility at times. The Fund is suitable to investors with a long-term investment horizon.

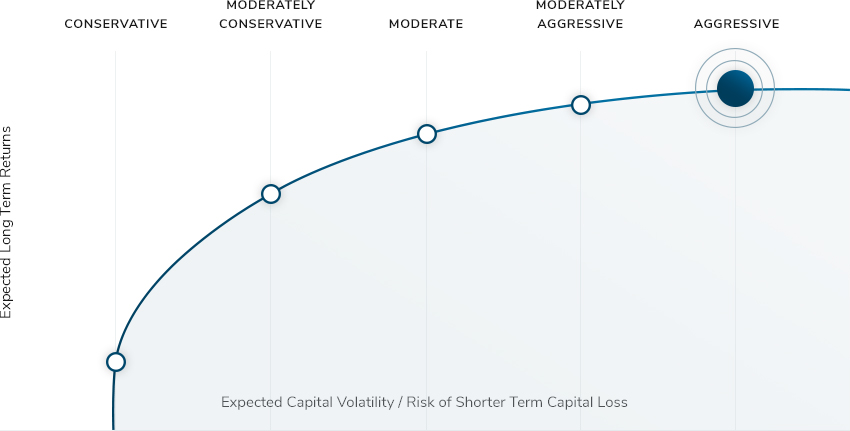

Risk Indicator = Aggressive

Risk Indicator Definition

These portfolios typically hold meaningful equity and/or offshore exposure which may result in significant capital volatility over all periods. Due to their nature expected long-term returns are higher than for the other risk categories.